Financial functions

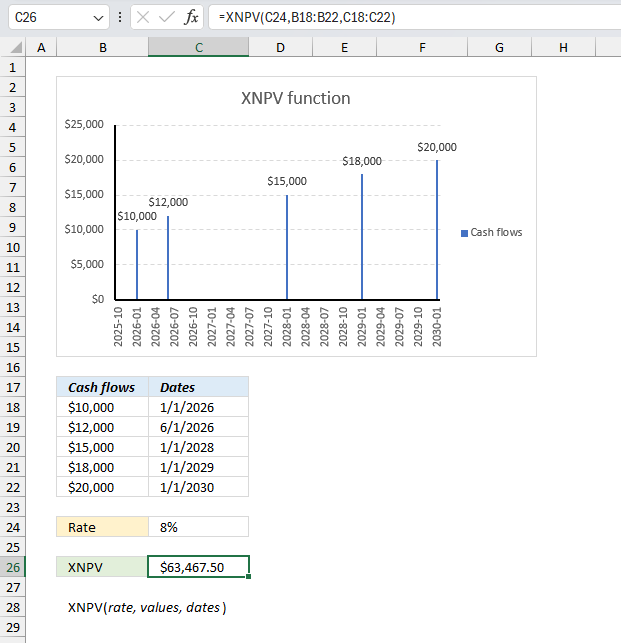

What is the XNPV function? The XNPV function calculates the net present value for cash flows that may or may […]

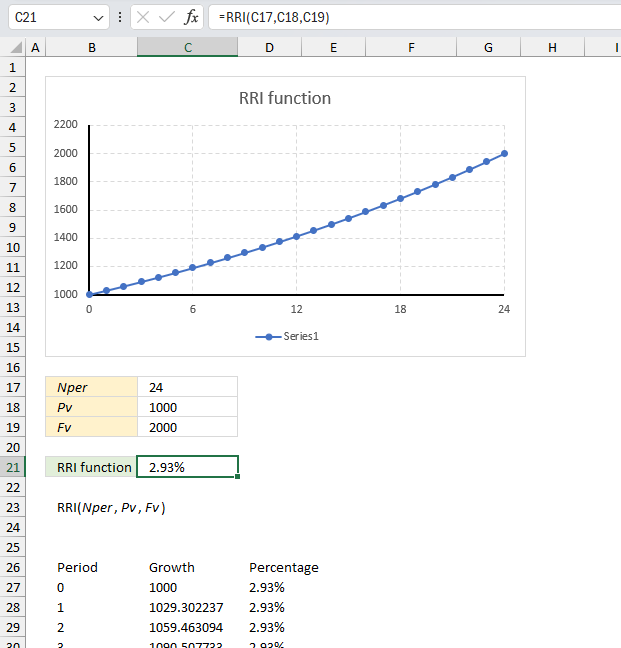

What is the RRI function? The RRI function calculates the growth of an investment in percent per period. Table of […]

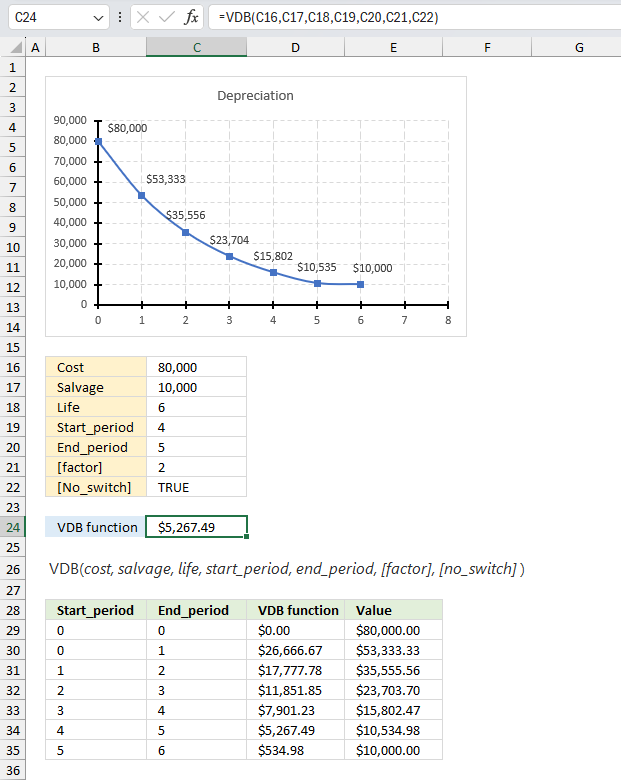

What is the VDB function? The VDB function calculates the depreciation of an asset for a given period using the […]

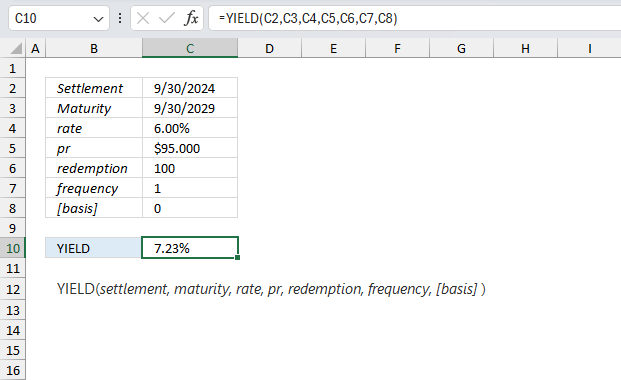

What is the YIELD function? The YIELD function calculates the yield for a security that pays interest. The YIELD function […]

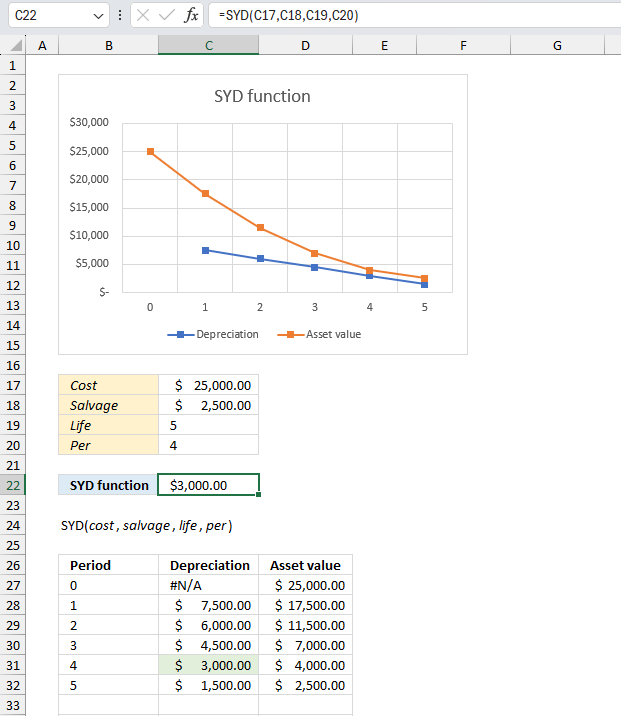

What is the SYD function? The SYD function calculates the yearly asset depreciation of a given year. Table of Contents […]

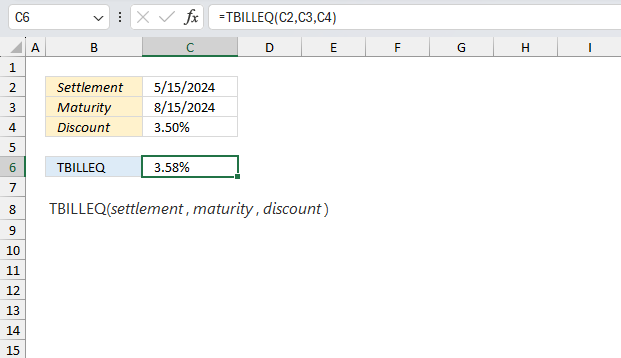

How to use the TBILLEQ function

What is the TBILLEQ function? The TBILLEQ function calculates the equivalent bond yield for a Treasury bill. It converts the […]

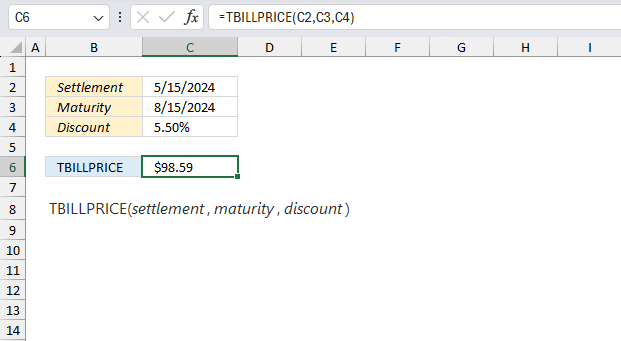

How to use the TBILLPRICE function

What is the TBILLPRICE function? The TBILLPRICE function calculates the par amount (face value) for a Treasury bill. Table of […]

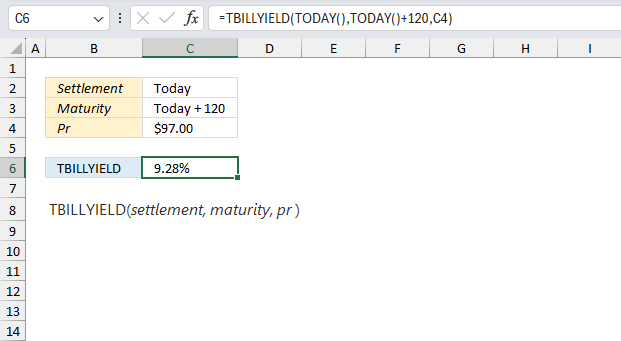

How to use the TBILLYIELD function

What is the TBILLYIELD function? The TBILLYIELD function calculates the yield for a Treasury bill. Table of Contents Introduction Syntax […]