How to use the TBILLEQ function

What is the TBILLEQ function?

The TBILLEQ function calculates the equivalent bond yield for a Treasury bill. It converts the T-bill discount rate to an equivalent annual yield for comparison to bonds.

Table of Contents

1. Introduction

What is a treasury bill?

A treasury bill, or T-bill, is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of 1 year or less that is sold at a discount from par in regular auctions.

What is the the equivalent bond yield for a Treasury bill?

The equivalent bond yield approximates the annual yield on a T-bill if held to maturity. It accounts for the fact that T-bills are issued at a discount and redeemed at par. The equivalent yield allows comparison between T-bills and coupon bonds.

What is the difference between TBILLYIELD an TBILLEQ fuctions?

TBILLYIELD calculates a T-bill's discount yield based on the purchase price.TBILLYIELD calculates the straight T-bill discount yield.

TBILLEQ converts T-bill discount yields to an annualized bond equivalent yield for comparison. TBILLEQ provides the equivalent bond yield. TBILLEQ lets you compare T-bill yields vs bond yields.

Excel functions for bonds and treasury bills

| Function | Description |

| TBILLEQ | Returns the bond-equivalent yield for a Treasury bill |

| TBILLPRICE | Returns the price per $100 face value for a Treasury bill |

| TBILLYIELD | Returns the yield for a Treasury bill |

| ACCRINT | Returns the accrued interest for a security that pays periodic interest |

| ACCRINTM | Returns the accrued interest for a security that pays interest at maturity |

| DURATION | Returns the annual duration of a security with periodic interest payments |

| MDURATION | Returns the Macauley modified duration for a security with an assumed par value of $100 |

| DISC | Returns the discount rate for a security |

| INTRATE | Returns the interest rate for a fully invested security |

How is the TBILLEQ function calculated?

Calculation formula:

TBILLEQ = (365 * rate)/(360-(rate*DSM))

DSM = days between settlement to maturity ignoring maturity date that is more than a year after settlement.

2. Syntax

TBILLEQ(settlement, maturity, discount)

| settlement | Required. The Treasury bill's settlement date which is the date after the issue date. |

| maturity | Required. The date when the security expires. |

| discount | Required. The Treasury bill's discount rate. |

What is the Treasury bill's settlement date?

The date after the issue date. A Treasury bill's settlement date is the date 1 business day after the auction when payment must be received and the bill is delivered to the buyer's account in exchange for the purchase price.

What is the Treasury bill's maturity?

The maturity date of a Treasury bill is the date when the bill's term expires, typically in 4, 8, 13, 26, or 52 weeks, and the Treasury repays the par value to the investor.

What is the Treasury bill's discount rate?

The Treasury bill's discount rate refers to the interest rate used to calculate the price of a T-bill when it is issued.

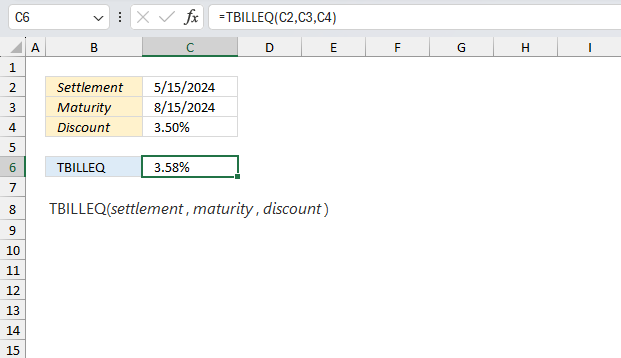

3. Example 1

Calculate the bond-equivalent yield for a Treasury bill with a settlement date of 05/15/2024, a maturity date of 08/15/2024, and a discount rate of 3.5%?

The TBILLEQ function has the following arguments:

- settlement: 05/15/2024 The settlement date for the Treasury bill.

- maturity: 08/15/2024 The maturity date for the Treasury bill.

- discount: 3.5% (0.035) The discount rate for the Treasury bill.

Formula in cell C6:

The formula in cell C6 returns 3.58% which represents the equivalent bond yield for a Treasury bill. The TBILLEQ function is calculated like this:

TBILLEQ = (365 * rate)/(360-(rate*DSM))

DSM = days between settlement to maturity ignoring maturity date that is more than a year after settlement.

Lets plug the arguments in to this math formula:

DSM = 8/15/2024 - 5/15/2024 = 92 days

(365*0.035)/(360-(0.035*92)) = 0.0358063792813499

3.58% is what we get in cell C6 as well.

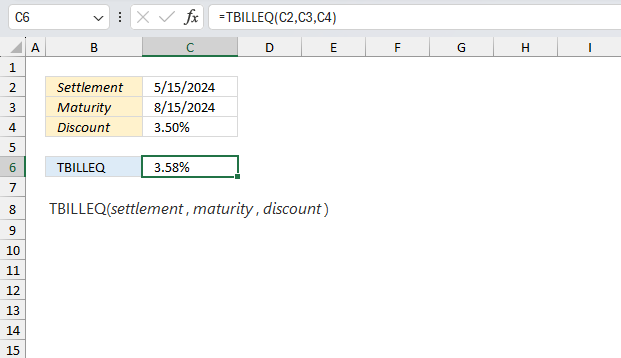

4. Example 2

Find the bond-equivalent yield for a Treasury bill purchased on 07/01/2024 that matures on 10/01/2024 with a discount rate of 2.8%?

In this example, the TBILLEQ function is being used to calculate the bond-equivalent yield for a Treasury bill with the following details:

- Settlement date: 07/1/2024 (The date when the Treasury bill was purchased)

- Maturity date: 10/1/2024 (The date when the Treasury bill matures and the face value is paid)

- Discount rate: 2.8% or 0.028 (The discount rate at which the Treasury bill was purchased, expressed as a decimal fraction of the face value)

The formula in cell C6:

The TBILLEQ function and passing in the values from cells C2 (settlement date), C3 (maturity date), and C4 (discount rate) as arguments. The TBILLEQ function calculates the bond-equivalent yield using the following formula:

TBILLEQ = (365 * rate) / (360 - (rate * DSM))

rate is the discount rate (0.028 in this case)

DSM is the number of days between the settlement date and the maturity date, ignoring any maturity date that is more than a year after the settlement date.

In this example, the DSM (days between settlement and maturity) is calculated as: DSM = 10/1/2024 - 07/1/2024 = 92 days

Plugging in the values, the TBILLEQ calculation becomes:

TBILLEQ = (365 * 0.028) / (360 - (0.028 * 92))

= 10.22 / (360 - 2.576)

= 10.22 / 357.424 = 0.0285934912037244 or 2.86%

This matches the result displayed in cell C6 which represents the bond-equivalent yield for the given Treasury bill details.

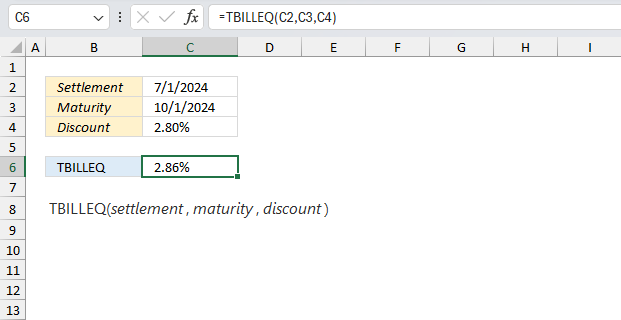

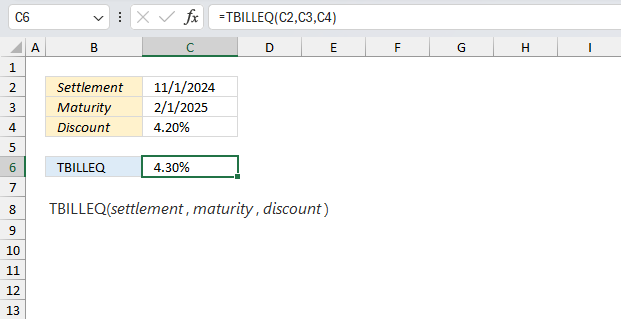

5. Example 3

A Treasury bill is purchased on 11/01/2024 and matures on 02/01/2025. If the discount rate is 4.2%, what is the bond-equivalent yield?

The TBILLEQ function has the following arguments:

- settlement: 11/1/2024 The settlement date for the Treasury bill.

- maturity: 2/1/2025 The maturity date for the Treasury bill.

- discount: 4.2% (0.042) The discount rate for the Treasury bill.

Formula in cell C6:

The formula in cell C6 returns 4.3% which represents the equivalent bond yield for a Treasury bill. The TBILLEQ function is calculated like this:

TBILLEQ = (365 * rate)/(360-(rate*DSM))

DSM = days between settlement to maturity ignoring maturity date that is more than a year after settlement.

Lets plug the arguments in to this math formula:

DSM = 11/1/2024 - 2/15/2024 = 92 days

(365*0.042)/(360-(0.042*92)) = 0.0430453534604758

4.30% is what we get in cell C6 as well.

6. Tips and tricks

Treasury bills are issued at a discount from the face value, the interest paid is the face value - purchase price.

Keep in mind to use the DATE function if you enter dates in the function as constant (hard coded values) instead of using cell references.

For example,

Date and time arguments are truncated to integers meaning the time part is removed.

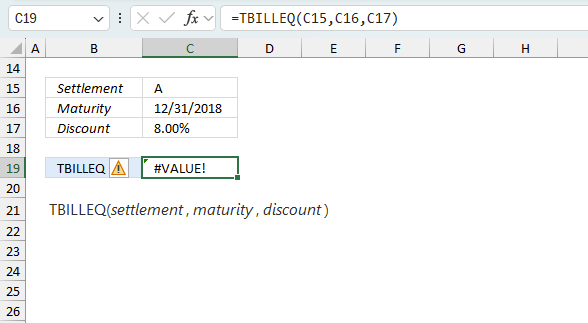

7. Why is the function not working?

The TBILLEQ function returns:

- #VALUE! error if settlement or maturity is not a valid data type.

- #NUM! error if

- discount <=0 (zero)

- settlement > maturity, or if maturity is more than a year after the settlement

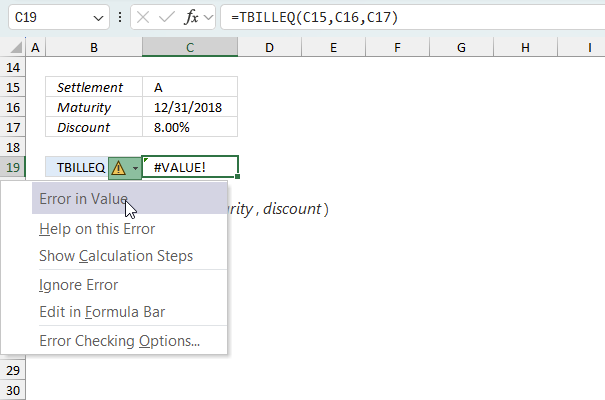

7.1 Troubleshooting the error value

When you encounter an error value in a cell a warning symbol appears, displayed in the image above. Press with mouse on it to see a pop-up menu that lets you get more information about the error.

- The first line describes the error if you press with left mouse button on it.

- The second line opens a pane that explains the error in greater detail.

- The third line takes you to the "Evaluate Formula" tool, a dialog box appears allowing you to examine the formula in greater detail.

- This line lets you ignore the error value meaning the warning icon disappears, however, the error is still in the cell.

- The fifth line lets you edit the formula in the Formula bar.

- The sixth line opens the Excel settings so you can adjust the Error Checking Options.

Here are a few of the most common Excel errors you may encounter.

#NULL error - This error occurs most often if you by mistake use a space character in a formula where it shouldn't be. Excel interprets a space character as an intersection operator. If the ranges don't intersect an #NULL error is returned. The #NULL! error occurs when a formula attempts to calculate the intersection of two ranges that do not actually intersect. This can happen when the wrong range operator is used in the formula, or when the intersection operator (represented by a space character) is used between two ranges that do not overlap. To fix this error double check that the ranges referenced in the formula that use the intersection operator actually have cells in common.

#SPILL error - The #SPILL! error occurs only in version Excel 365 and is caused by a dynamic array being to large, meaning there are cells below and/or to the right that are not empty. This prevents the dynamic array formula expanding into new empty cells.

#DIV/0 error - This error happens if you try to divide a number by 0 (zero) or a value that equates to zero which is not possible mathematically.

#VALUE error - The #VALUE error occurs when a formula has a value that is of the wrong data type. Such as text where a number is expected or when dates are evaluated as text.

#REF error - The #REF error happens when a cell reference is invalid. This can happen if a cell is deleted that is referenced by a formula.

#NAME error - The #NAME error happens if you misspelled a function or a named range.

#NUM error - The #NUM error shows up when you try to use invalid numeric values in formulas, like square root of a negative number.

#N/A error - The #N/A error happens when a value is not available for a formula or found in a given cell range, for example in the VLOOKUP or MATCH functions.

#GETTING_DATA error - The #GETTING_DATA error shows while external sources are loading, this can indicate a delay in fetching the data or that the external source is unavailable right now.

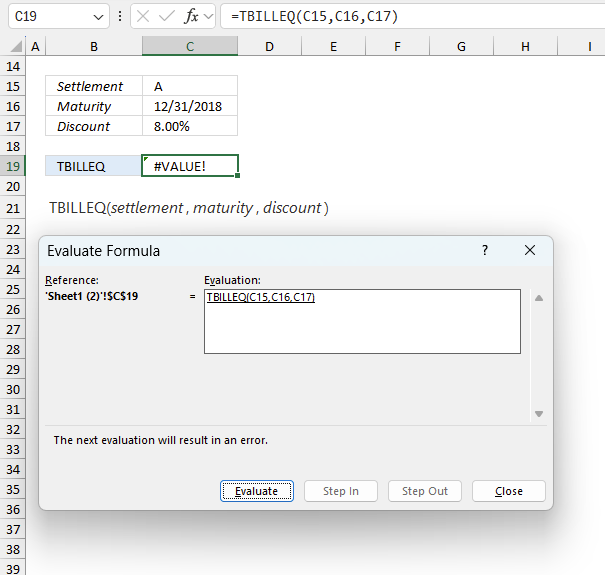

7.2 The formula returns an unexpected value

To understand why a formula returns an unexpected value we need to examine the calculations steps in detail. Luckily, Excel has a tool that is really handy in these situations. Here is how to troubleshoot a formula:

- Select the cell containing the formula you want to examine in detail.

- Go to tab “Formulas” on the ribbon.

- Press with left mouse button on "Evaluate Formula" button. A dialog box appears.

The formula appears in a white field inside the dialog box. Underlined expressions are calculations being processed in the next step. The italicized expression is the most recent result. The buttons at the bottom of the dialog box allows you to evaluate the formula in smaller calculations which you control. - Press with left mouse button on the "Evaluate" button located at the bottom of the dialog box to process the underlined expression.

- Repeat pressing the "Evaluate" button until you have seen all calculations step by step. This allows you to examine the formula in greater detail and hopefully find the culprit.

- Press "Close" button to dismiss the dialog box.

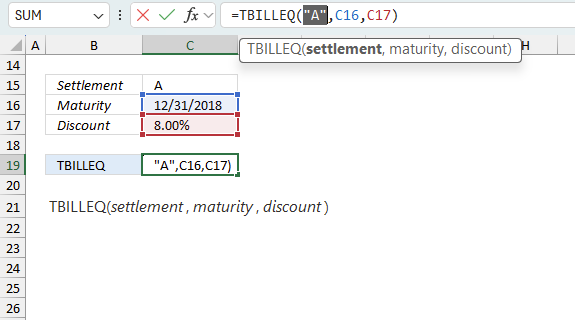

There is also another way to debug formulas using the function key F9. F9 is especially useful if you have a feeling that a specific part of the formula is the issue, this makes it faster than the "Evaluate Formula" tool since you don't need to go through all calculations to find the issue..

- Enter Edit mode: Double-press with left mouse button on the cell or press F2 to enter Edit mode for the formula.

- Select part of the formula: Highlight the specific part of the formula you want to evaluate. You can select and evaluate any part of the formula that could work as a standalone formula.

- Press F9: This will calculate and display the result of just that selected portion.

- Evaluate step-by-step: You can select and evaluate different parts of the formula to see intermediate results.

- Check for errors: This allows you to pinpoint which part of a complex formula may be causing an error.

The image above shows cell reference C15 converted to hard-coded value using the F9 key. The TRIMMEAN function requires Excel dates (numerical values) which is not the case in this example. We have found what is wrong with the formula.

Tips!

- View actual values: Selecting a cell reference and pressing F9 will show the actual values in those cells.

- Exit safely: Press Esc to exit Edit mode without changing the formula. Don't press Enter, as that would replace the formula part with the calculated value.

- Full recalculation: Pressing F9 outside of Edit mode will recalculate all formulas in the workbook.

Remember to be careful not to accidentally overwrite parts of your formula when using F9. Always exit with Esc rather than Enter to preserve the original formula. However, if you make a mistake overwriting the formula it is not the end of the world. You can “undo” the action by pressing keyboard shortcut keys CTRL + z or pressing the “Undo” button

7.3 Other errors

Floating-point arithmetic may give inaccurate results in Excel - Article

Floating-point errors are usually very small, often beyond the 15th decimal place, and in most cases don't affect calculations significantly.

Functions in 'Financial' category

The TBILLEQ function function is one of 27 functions in the 'Financial' category.

How to comment

How to add a formula to your comment

<code>Insert your formula here.</code>

Convert less than and larger than signs

Use html character entities instead of less than and larger than signs.

< becomes < and > becomes >

How to add VBA code to your comment

[vb 1="vbnet" language=","]

Put your VBA code here.

[/vb]

How to add a picture to your comment:

Upload picture to postimage.org or imgur

Paste image link to your comment.

Contact Oscar

You can contact me through this contact form