How to use the AMORDEGRC function

What is the AMORDEGRC function?

The AMORDEGRC function calculates the depreciation for each accounting period. This function is designed for the French accounting system.

The prorated depreciation is taken into account if an asset is purchased in the middle of the accounting period. There is a depreciation coefficient taken into account in the calculation based on the life of the assets.

This function will calculate the depreciation for all periods except the last period of the life of the assets or if the cumulated value of depreciation is greater than the cost of the assets minus the salvage value.

What is depreciation?

Depreciation is an accounting method that allows businesses to allocate the cost of a tangible asset over its useful life. It represents how much of an asset’s value has been used up over time.

Depreciation helps businesses to match their expenses with their revenues, and to reduce their taxable income by deducting the depreciation expense.

What is an accounting period?

An accounting period is a span of time that covers certain accounting functions such as recording transactions etc. Some common types of periods are: Calendar year, fiscal year, and interim periods.

What is salvage value?

Salvage value is the estimated value of an asset at the end of its useful life. It is also known as scrap value or residual value. It is used to calculate the depreciation expense of an asset over its useful life.

What is prorated depreciation?

Prorated depreciation is a way of calculating the depreciation expense of an asset based on the proportion of time it is used in a given period. Prorated depreciation is often used when an asset is acquired or disposed of in the middle of an accounting period, and the depreciation method depends on the number of years or months of service. Prorated depreciation allows the business to match the expense of the asset with the revenue it generates more accurately.

Excel Function Syntax

AMORDEGRC(cost, date_purchased, first_period, salvage, period, rate, [basis])

Arguments

| cost | Required. |

| date_purchased | Required. |

| first_period | Required. The date of the end of the first period. |

| salvage | Required. The salvage value. |

| period | Required. |

| rate | Required. The rate of depreciation. |

| [basis] | Required. The year count. |

| Basis | Day count |

| 0 (default) | 360 (NASD) |

| 1 | Actual |

| 3 | 365 |

| 4 | European 360 |

| Life of asset | Coefficient |

| Between 3 and 4 years | 1.5 |

| Between 5 and 6 years | 2 |

| More than 6 years | 2.5 |

The depreciation rate will grow to 50 percent for the period before the last period and grows to 100 percent for the last period.

Comments

Keep in mind to use the DATE function if you enter dates in the function instead of using cell references.

For example,

Date arguments are truncated to integers.

The AMORDEGRC function returns:

- #NUM! error If the life of assets is between 0 (zero) and 1, 1 and 2, 2 and 3, or 4 and 5

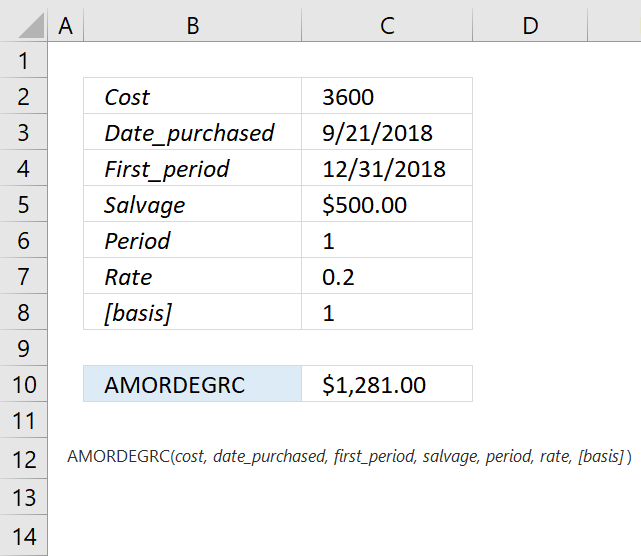

AMORDEGRC function example

Formula in cell C6:

Functions in 'Financial' category

The AMORDEGRC function function is one of 29 functions in the 'Financial' category.

How to comment

How to add a formula to your comment

<code>Insert your formula here.</code>

Convert less than and larger than signs

Use html character entities instead of less than and larger than signs.

< becomes < and > becomes >

How to add VBA code to your comment

[vb 1="vbnet" language=","]

Put your VBA code here.

[/vb]

How to add a picture to your comment:

Upload picture to postimage.org or imgur

Paste image link to your comment.

Contact Oscar

You can contact me through this contact form